- Author Maria Gibbs gibbs@autolifeadvice.com.

- Public 2023-12-16 03:05.

- Last modified 2025-01-22 17:47.

It is very easy to buy a car on credit. You don't need to have a lot of money for this. As a rule, the initial payment is 10 - 20% of the cost of the car. The most difficult thing will be then, when the time comes to pay off this loan. It is good if your financial condition is improving, and what to do when income decreases. When choosing a loan, it is important to consider not only the loan amount, interest, payment amount, but also financial risks.

Oftentimes, the desire to drive a new car makes people do stupid things. Regardless of his financial situation, a person buys a new car on credit. After a while, he has nothing to pay with and he sells the car. To prevent this from happening, you need to choose the right loan, as well as prepare your financial protection.

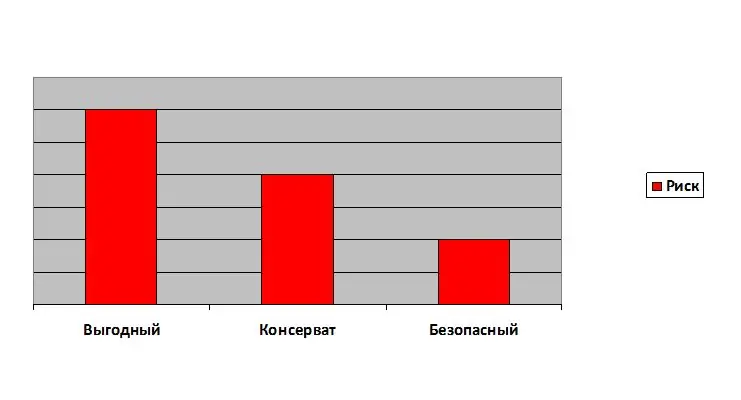

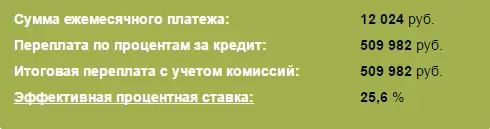

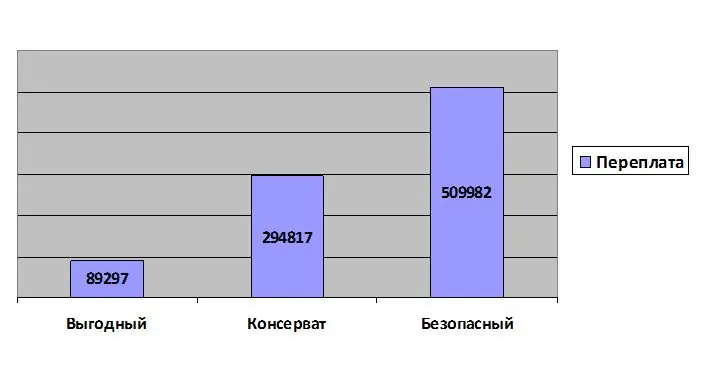

When choosing a loan, I recommend considering 3 options. This is a profitable loan, a conservative loan and a safe loan. The amount of overpayment on these loans is different. A good loan has a small overpayment, but a higher risk. A secure loan will allow you to live more peacefully, but interest payments will be substantial.

Let's dwell on each option in more detail. For the calculation, consider a car worth 1,000,000 rubles. We will not consider the aggressive option of a loan, when you have only 100,000 thousand rubles in your hands, and the rest of the amount is on credit. Not everyone will be able to pull monthly payments in the amount of 30,000 rubles. It would be most correct and reasonable to accumulate a certain amount of money, and only then apply for a loan. Let's say you sold your old car and saved up money. And your capital is 500,000 rubles.

A profitable loan is issued for a shorter period, correspondingly high monthly payments. Due to this, the overpayment will be minimal. A short term loan should be considered a period of up to 3 years. The most profitable loan is a car loan, as the interest on the loan is significantly lower than that of a consumer loan. As a rule, when applying for a car loan, a CASCO is required. But there are banks in which CASCO registration is not a prerequisite. Auto loan will be the most profitable loan, with minimal interest and a small overpayment.

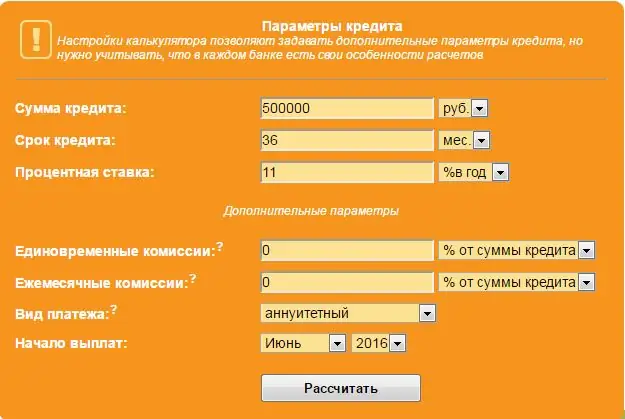

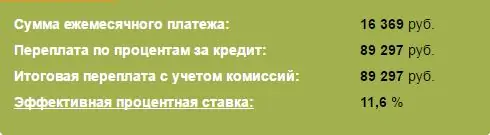

For the calculation we use a credit calculator on the website www.calculator-credit.ru. Let's introduce the following parameters: the loan amount is 500,000 rubles, the loan term is 36 months, the interest rate is 11%.

The monthly payment will be 16369 rubles, the overpayment of interest will be 89297 rubles.

When applying for a car loan, remember that the car will be pledged by the bank, so you cannot sell it.

Now let's look at a conservative type of loan. This option is suitable for a larger number of citizens, since it has low monthly payments. The payment amount was reduced by increasing the loan term to 5 years. For such a period, only consumer loans are issued. To get a favorable interest rate, contact the bank that issues your salary. As a rule, there are special lending programs for such clients, and you will receive favorable conditions.

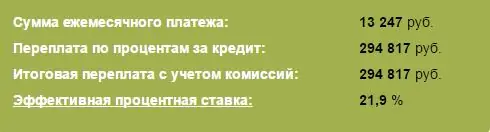

Let's enter the following parameters into the loan calculator: the loan amount is 500,000 rubles, the loan term is 60 months, the interest rate is 20%.

The monthly payment will be 13,247 rubles, the overpayment of interest will be 294,817 rubles.

Such a loan has a lower monthly payment and your car will not be pledged to the bank.

The third type of loan is safe. Suitable for people with low income, or who do not want to quickly repay the loan, and spend free money on other needs. Choose a bank that will issue a consumer loan for a longer period, for example, 84 months. Due to this, the monthly payment will be even less. However, the interest rate will increase. The total interest overpayment will be higher, but you will be safer. Such a loan is more flexible because you can manage your payments. That is, with a small monthly payment, you can always pay more money on the loan and save on interest. And when your income drops, you can return to the minimum payment amount.

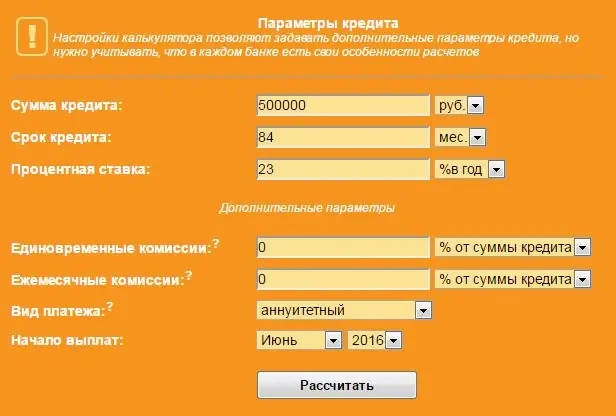

Let's enter the following parameters into the loan calculator: the loan amount is 500,000 rubles, the loan term is 84 months, the interest rate is 23%.

The monthly payment will be 12,024 rubles, the overpayment of interest will be 509,982 rubles.

As a result, the overpayment on the loan will be huge, but you have a lower monthly payment and do not forget about inflation. In 7 years the money will become worthless, and you will be giving back money that has a different weight.

Now let's compare all three loan options.

When choosing a loan, assess your financial situation. Calculate your income and expenses. Can you pay off a profitable loan? If payments will take all of your income, consider whether it is worth the risk and taking out such a loan. Saving money is very good, but taking such a loan when there is no money left in stock will be a wrong decision. Think about what you will do if your income decreases and there is nothing to pay. You won't be able to sell the car, since it is pledged.

When applying for any loan, you need to assess your risks and know what to do when the main income falls. I advise you to prepare financial protection. It is necessary to create a cash safety cushion. If the loan payments are very large for you, you need to postpone the purchase and save up some more money. Create a cash reserve of 6 monthly payments. This way, you will have a supply of money that you can use during the most difficult times.

This technique can be used for any car value. Enter the required cost of the car in the loan calculator and get other calculation results.

Remember that loan payments are not all expenses when buying a car. Every year you have to pay insurance, taxes, buy parts and other running costs with the car.